Lancar - loan lending

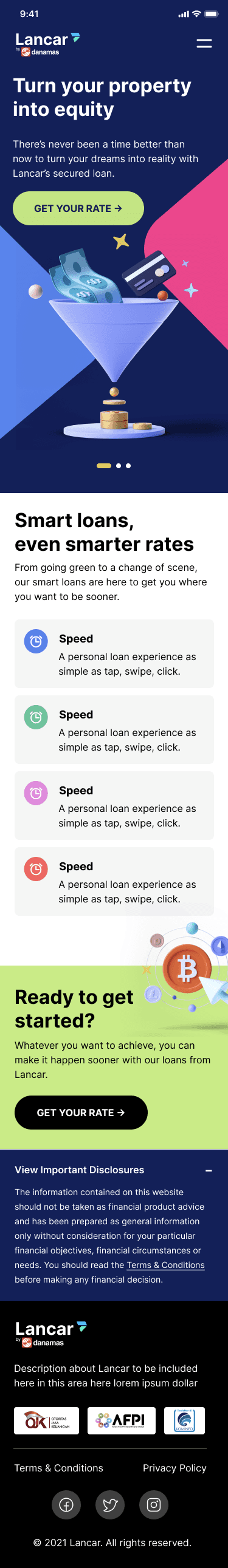

LANCAR, a loan lending portal/app was an application for an Asian banking major with a goal to build an Innovative Digital Lending Business.

The application focused on becoming the simplest and fastest secured lending provider with aggressive and effective market penetration supported by a sustainable business and service model.

User Personas

User Personas

Existing and new customers of the bank, that required loans against existing collaterals (home, jewellery, bonds etc.)

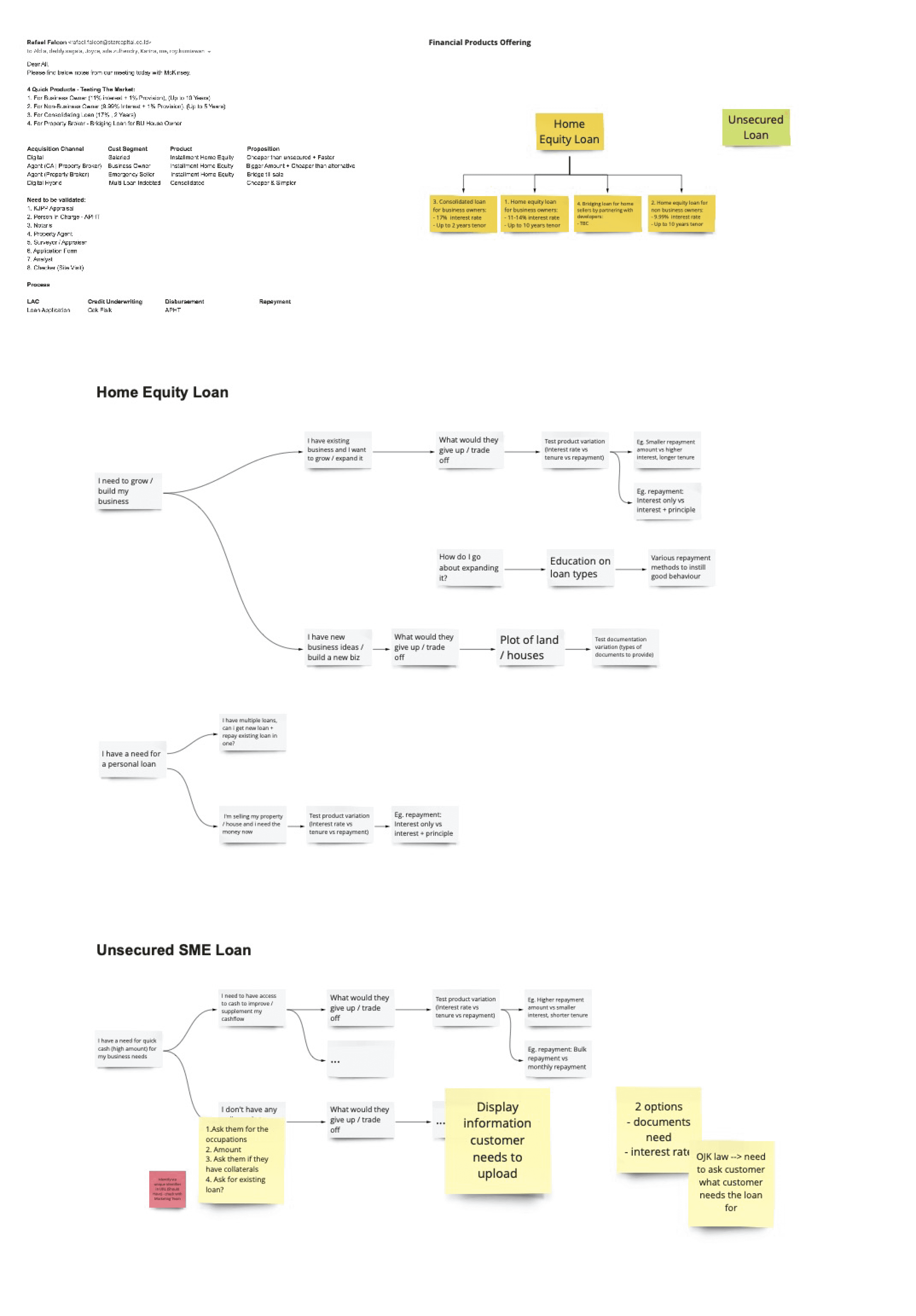

Reduced interest rates for customers who are contemplating their decision

Development of ‘notional collateral’ offer for low ticket good customers

Create new unsecured business loan product to supplement certain customers

Create incentives for all parties participating in a single loan

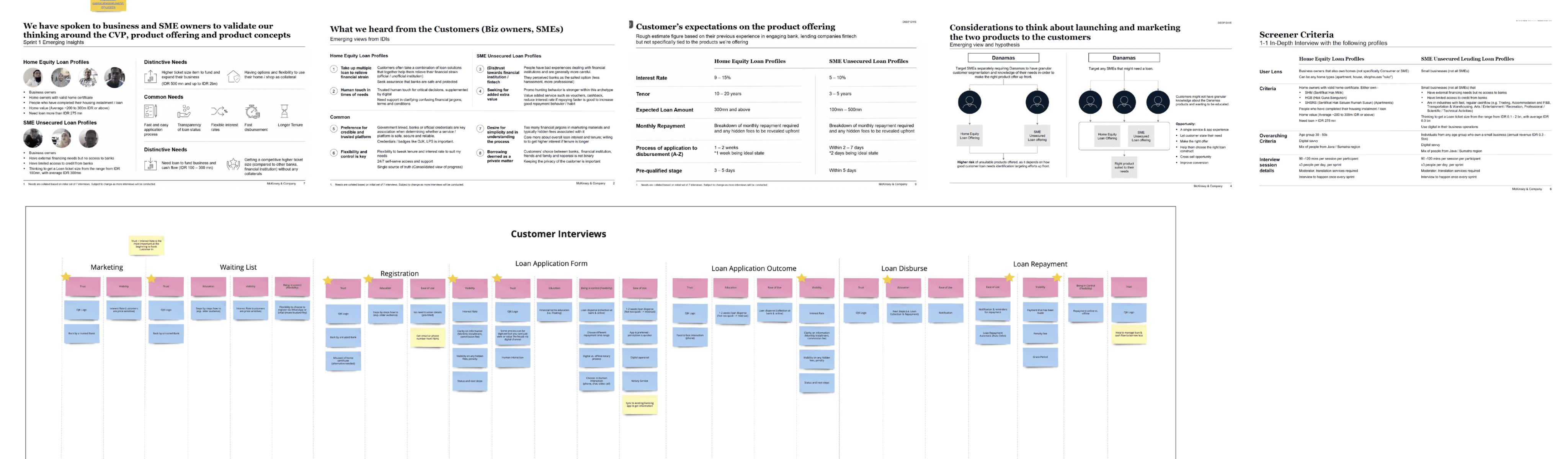

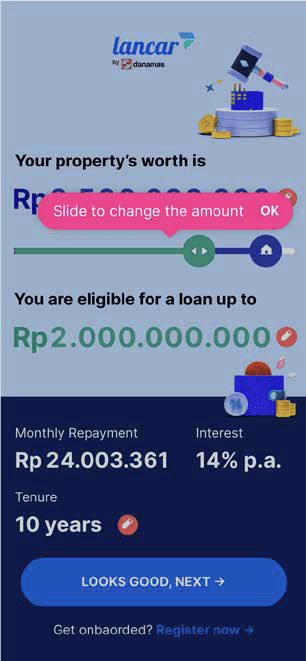

We started the UX process by collecting user insights through user interviews of their requirements for collateral based loan lending processes.

We identified significant issues including false perception between P2P lending and illegal lending, underbanked and underserved SMEs, low Corporate and Product awareness, and low financial literacy.

We then created an action plan to mitigate these issues by executing regular digital activity for which we started mapping out the user journeys and profiles, wire-framing and building the LANCAR app/portal.

We finally validated our designs and journeys through comprehensive user testing and incorporating feedback.

DEFINING THE GOAL

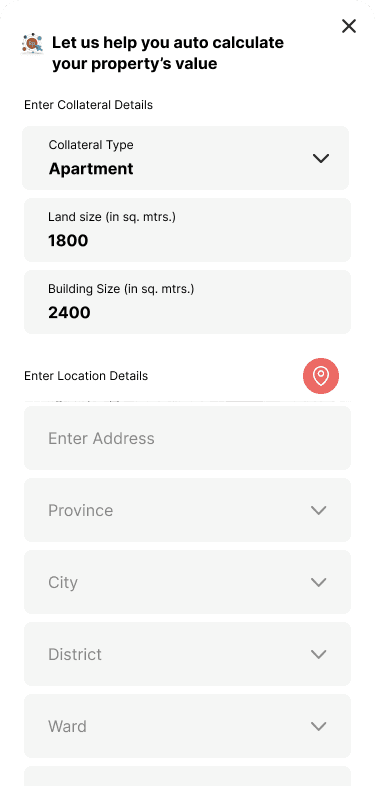

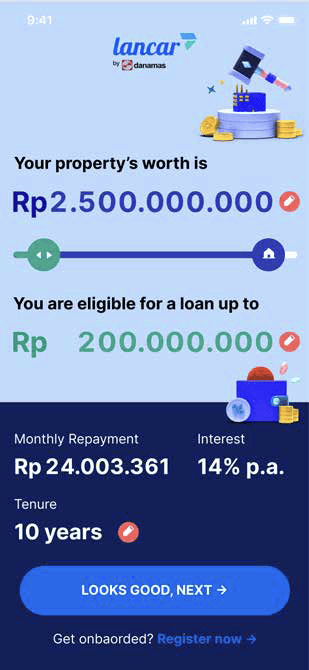

The goal was to give the user the liberty to decide the loan amount for themselves within the threshold that the bank has provided them against the collateral that they have provided

USER INTERVIEWS & INSIGHTS

We conducted multiple interviews with different stakeholders. The insights gained from these interactions helped us define valuable components of the design and development process.

Scroll right to view all the insights gathered during the interviews process

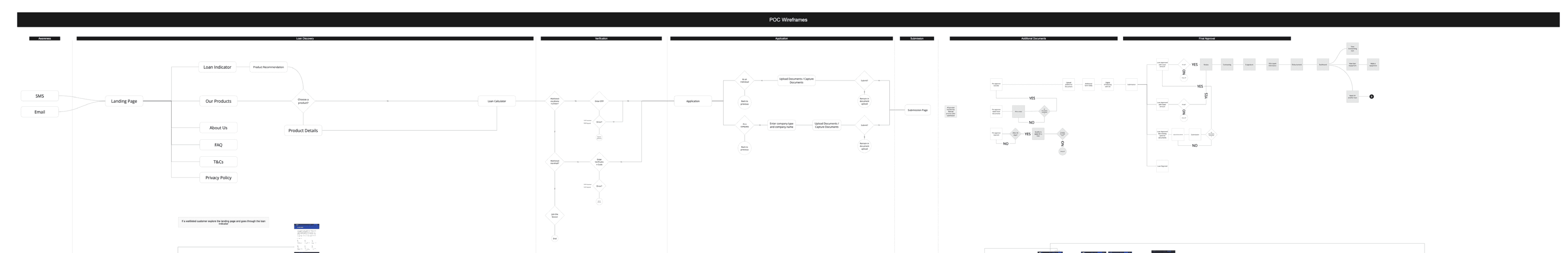

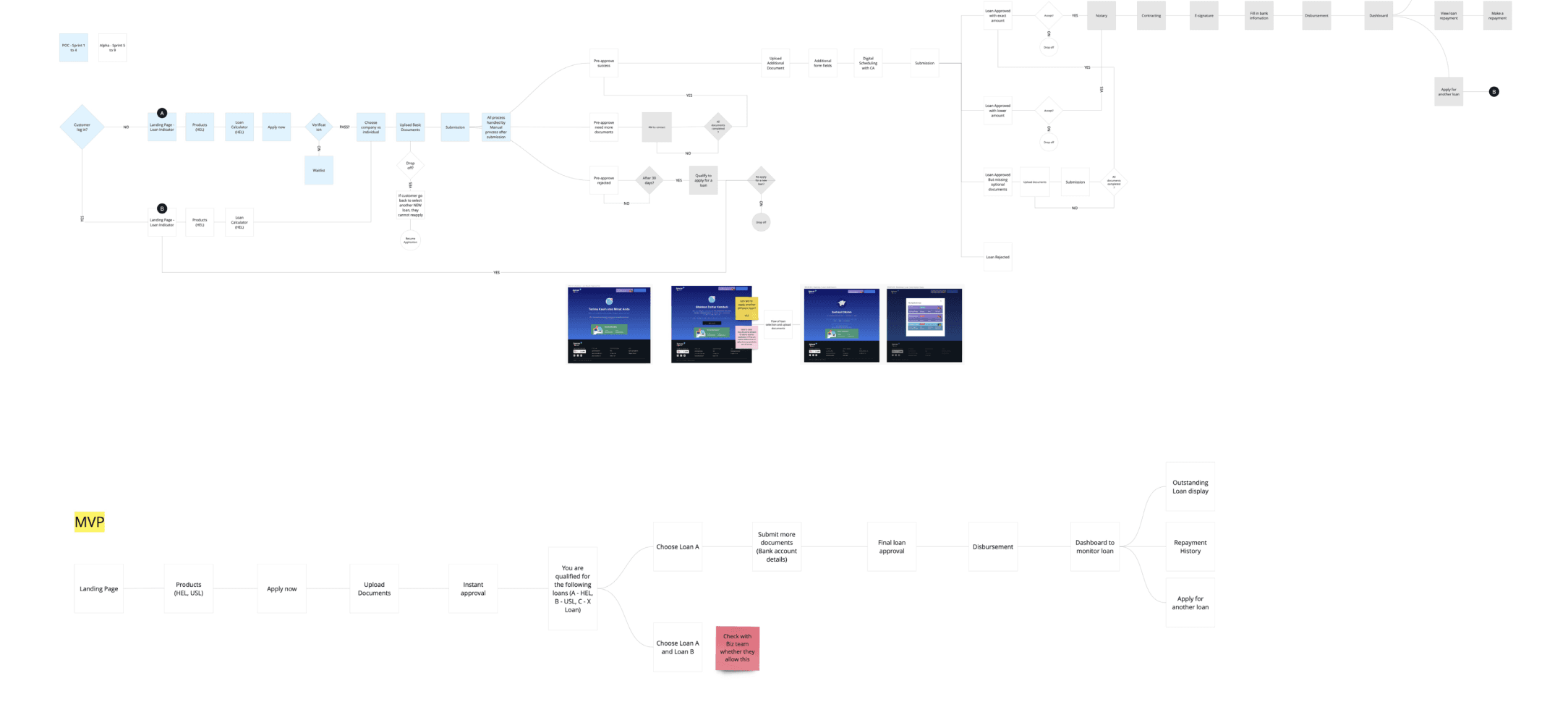

Redesigning of the journey involved mapping out the ideal flow of the process that a user can take to complete their tasks

This process involved revisiting and refining the visual representation of a user's interactions with our product, and is driven by the goal of improving the overall user experience. Few steps that we took to redesign the journey :

REDESIGNING THE JOURNEY MAP

Scroll right to view all the insights gathered during the interviews process

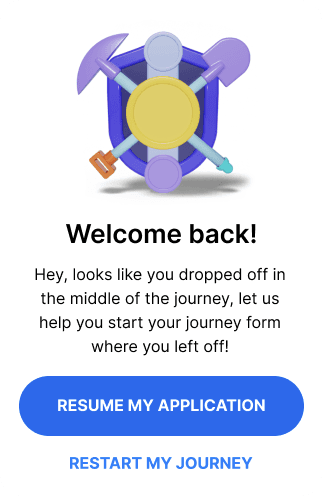

We mapped various use cases and edge scenarios for the alternate journeys that users can take under different conditions

USE CASES

Scroll right to view more

User Persona Alignment

Implementation and Monitoring

Collaboration with Stakeholders

Testing and Validation

Define Redesign Objectives

Incorporating Feedback

User Interviews and Research

Assessment of Current Journey Map

Accessibility Considerations

Mapping Touchpoints and Interactions

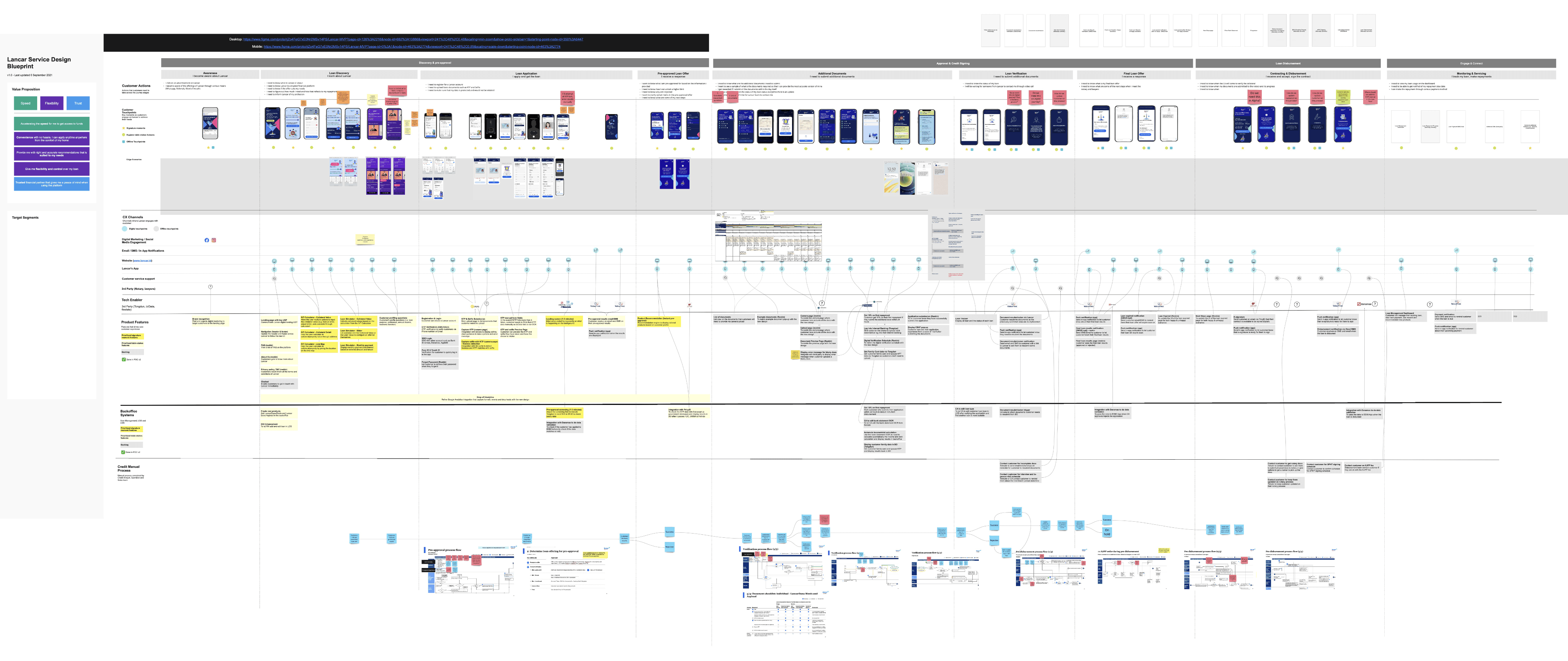

We built the entire loan lending journeys with all the online and offline touchpoints involving every stakeholder and defining different channels and busines processes involved in this service offering.

Service Design Blueprint

Scroll right to view more

THE VISUAL DESIGN

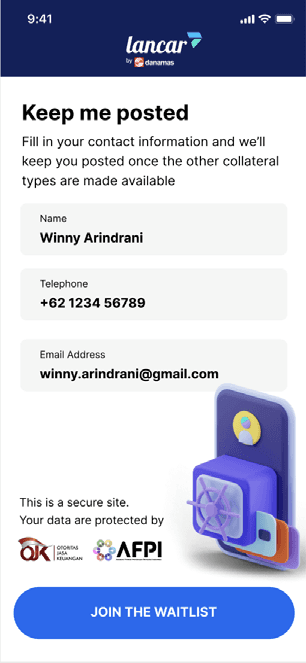

The product had several unique features the primary of which was the slider that would help a user ascertain their property as well as loan value. The slider was correlational and allowed the user to independently change the values and customize their own offers and not just be system dependent. This gave unparalleled flexibility to the user and was widely appreciated during UAT, business reviews, and stakeholder feedback.

THE HIGHLIGHT

**This was a client project. Please contact for more details!